News

Project developer study: CA Immo is second largest office developer in Germany

• Percentage of investor development grows to 40 percent

• Above all, office and hotel real estate is being built for own portfolios

• CA Immo is the second largest office project developer in Germany

• Office market forecast Germany: bulwiengesa forecasts continued employment growth, low vacancy rates and rising rents in the coming years

Berlin, 16 September 2019.

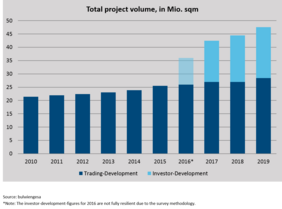

Commercial real estate in Germany is increasingly being developed by institutional investors for their own portfolio. This is shown in a special analysis of the project developer study that was prepared by bulwiengesa for CA Immo in addition to the traditional trader development study. “The market share of investor developments (portfolio developments) in project development volume has increased from around 20 percent in 2016 to around 40 percent in 2019,” explains Andreas Schulten, Chief Representative of bulwiengesa.

“CA Immo, like several other investors, prefers to develop own projects in the current market environment rather than waiting for properties that match the portfolio strategy,” says Andreas Quint, CEO of CA Immo, one of the leading office investors, asset managers and developers in Central Europe. Andreas Schulten adds: “On the other hand, more and more developers are building their own portfolios, instead of constantly looking for land and investment opportunities. As a result, the volume of investor development is increasing rapidly, while the volume of trading developments has remained almost constant.”

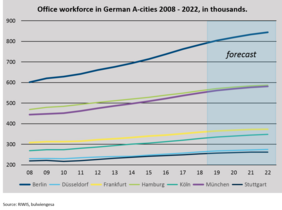

Office development as a growth sector: office workforce is growing, vacancy rates are declining

Significant differences exist between the individual types of use. While the volume of residential developments is also virtually stagnating in investor developments, a clear or disproportionate increase in hotels, and especially in offices, can be observed. The economic background for increased investor developments in the office segment is the strong growth in the office workforce and the declining vacancy rates in the top cities. “Both trends are particularly pronounced in Berlin,” explains Andreas Schulten. “Similarly, office completion numbers will increase from around 260,000 square meters in 2018 to approximately 520,000 square meters in 2022. All other top cities will remain largely at a relatively low level.” Schulten adds: “We expect a further increase in the office workforce in the coming years. According to our forecast, Berlin is expected to have about 850,000 office workers in 2022, an increase of 42 percent over 2008.” According to bulwiengesa, the growth in the office workforce in recent years will also continue in Munich and Hamburg.

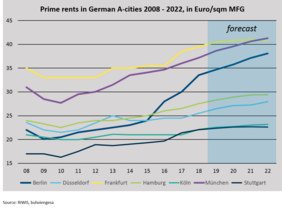

Bulwiengesa office market forecast: Prime Office Rents will continue to rise, especially in Berlin, Munich and Frankfurt

Despite the increasing construction activity, Schulten sees no turnaround in vacancies: “Unlike in previous cycles, according to our office market forecast we do not expect to see an increase in office vacancies in the metropolises until 2022,” says Schulten. Berlin and Munich are very similar in terms of vacancy rates and will not reach more than two percent in 2022. A similar picture emerges for rents in the office market forecast until 2022: “Prime office rents will continue to rise, especially in Berlin, Munich and Frankfurt,” says Schulten. Berlin has recorded the strongest increase since 2018 (+14 percent), followed by Munich and Düsseldorf with a growth of around 10 percent each. According to bulwiengesa, Munich will also replace Frankfurt as the most expensive office location from 2022 onwards.

In the office segment, investor development space is mainly present in Berlin and Munich. In the Bavarian state capital, the share of investor developments in offices has increased by 44 percent since 2016 to 1.3 million square meters in 2019. Across all types of use, developments for own portfolios in Munich make up almost 63 percent of the project volume. In Berlin and Stuttgart, 47.5 percent and 47.8 percent respectively were achieved. In Hamburg, 44 percent of the space is being built for own portfolios.

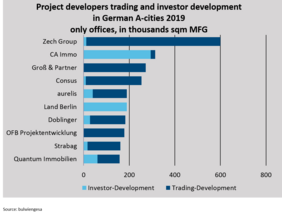

CA Immo is second largest office developer in Germany

Measured by the total project volume (trader and investor developments) in the office real estate segment, the ZECH Group is the largest developer in Germany. The second largest developer is CA Immo, with developments primarily for its own portfolio, followed by Groß & Partner (only trading developer) and CONSUS. CA Immo CEO Andreas Quint comments: “We are about 85 percent owner and 15 percent developer, which is a very profitable combination for us. The focus is on high-quality office real estate in the metropolises of Central Europe.” CA Immo is growing in Germany mainly on the basis of its own project developments. The growth engine of the company is above all the German project pipeline, which includes current projects under construction as well as a planned project pipeline based on current land reserves with a total development volume of more than 750,000 square meters of floor space. This project pipeline includes top locations in Berlin, Munich and Frankfurt.

About CA Immo

CA Immo is the specialist for office real estate in Central European capitals. The company covers the entire value chain in the commercial property sector: Rental and management of existing objects and project development with high in-house construction expertise. Founded in 1987, the company is listed on the ATX of the Vienna Stock Exchange and has real estate assets of approx. € 4.7 billion in Germany, Austria and Eastern Europe. The real estate company is one of the leading portfolio holders and developers of high-quality office buildings in Germany’s top 3 locations (Berlin, Munich, Frankfurt). Around 46 percent of the portfolio is located in Germany where the company has real estate assets of over € 2.2 billion, primarily in Berlin, Frankfurt and Munich, of which approx. € 800 million in real estate assets are under development.

About bulwiengesa

bulwiengesa is one of the largest independent analysis companies in the real estate industry in continental Europe. For more than 30 years, bulwiengesa has supported its partners and customers in matters concerning the real estate industry, location and market analysis with sound data services, strategic advice, custom reports and more. The data provided by bulwiengesa is used by among others the Deutsche Bundesbank for the ECB, BIS and OECD.

Press Contact bulwiengesa AG

Sigrid Rautenberg

Tel.: +49 (0) 30-278768 24

E-mail: rautenberg@bulwiengesa.de

www.bulwiengesa.de

Press Contact CA Immobilien Anlagen AG

Mag. Susanne Steinböck

Tel.: +43/1/532 59 07-533

E-mail: susanne.steinboeck@caimmo.com

You can download the presentation for the special analysis of the project developer study from the following link (German only):

https://www.caimmo.com/de/presse/videos-und-downloads/